By Chaipat Poonpatpibul, Simon Liu, Zhiwen Jiao

The COVID-19 pandemic has been casting a shadow over the global economy, pushing policymakers in the ASEAN+3 region to undertake unprecedented monetary policy easing to support the economies.

Substantial and unconventional measures across the region

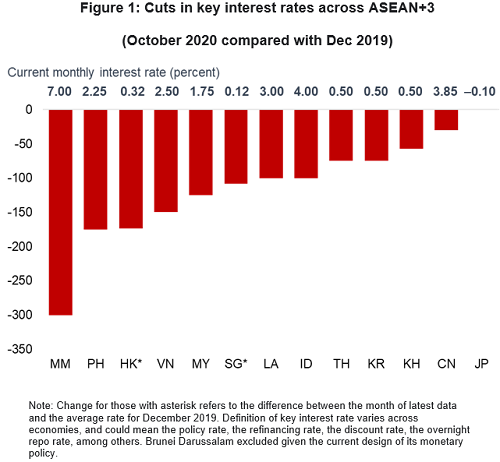

The policy response has been prompt with varied sizes and scopes across countries. The benchmark policy rates were cut in swift successions since the start of the virus outbreak in early 2020 (Figure 1).

As the impact of the pandemic is severe and enduring especially due to lockdowns and social distancing measures, there has been a need for substantial easing to support regional economies and to ensure that financial markets are functioning in an orderly manner. This endeavor can be especially challenging for countries whose monetary policy space is diminishing rapidly due to the much lower policy rates and weakening external and financial conditions.

Given the reduced monetary policy space, many ASEAN+3 countries have complemented the rate cuts by relaxing selective macro-prudential policy measures, adopting unconventional monetary policies, and boosting their financing relief measures and regulatory forbearance to support lending amid mitigate default risks.

Country-specific approaches

Authorities in all the regional economies adopted measures that allow for deferment of loan repayments and expand credit guarantees on loans. In addition, regulators in several economies such as Hong Kong, Malaysia, Singapore, and Thailand also allowed greater flexibility in banks’ loan classification.

Regulators in China, Indonesia, Malaysia, and the Philippines lowered the reserve requirement ratio and regulatory funding ratio, while Hong Kong reduced the countercyclical capital buffers.

Central banks in Korea and Thailand adopted unconventional policies in terms of providing a backstop to avoid a liquidity squeeze and prevent rollover risks in the local bond markets. These measures include purchasing government bonds held by banks and nonbank financial institutions, and pre-emptively setting aside bridge financing for high-quality corporates with bonds maturing in the near-term.

In addition to fostering smooth credit flows, many monetary authorities provide supports to local financial markets in the event of significant market stress.

Several countries, such as Singapore and Korea, entered into special swap arrangements with the U.S. Fed to obtain USD funding to meet demands for USD liquidity in their domestic markets.

Similarly, Bank Negara Malaysia and Bank Indonesia entered into a repo arrangement with the US Fed to obtain USD funding. In addition, Bank Indonesia agreed to finance the government’s fiscal packages through direct purchases of government securities in the primary market and share the interest burden with the government.

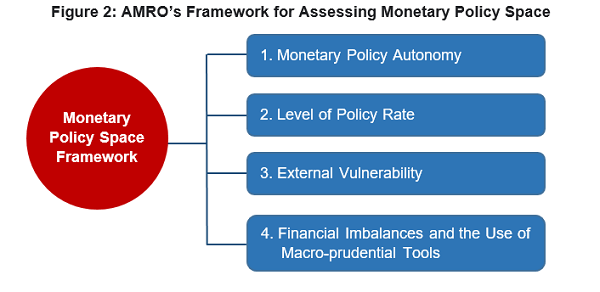

Using AMRO’s framework of assessing monetary policy space (Figure 2), we assess that policy space across the region has narrowed. The policy rates of Korea and Thailand are approaching the zero lower bound, while many others are reaching historical lows.

Nonetheless, policy actions to ease regulations, provide special loans, and ensure adequate domestic and U.S. dollar liquidity in the financial system have helped preserve some monetary space while bolstering external and financial stability.

Policy Recommendations

At this juncture, although there is scope for further easing, countries that have external constraints and elevated financial imbalances should be cautious in doing so.

Financial relief measures, time-bound regulatory forbearance, and debt moratorium can be extended to help hard-hit households and businesses to provide income and liquidity support and avoid an abrupt surge in bankruptcy.

Unconventional monetary policies can be carefully considered as part of the monetary policy toolkit, given the narrowing policy space. However, the design and implementation of these tools, especially for emerging economies, should be done cautiously to minimize potential side effects.

Should the country encounter destabilizing capital outflows, capital flow management measures can be cautiously deployed. The usage should be temporary, taking into account the potential negative impact on investors’ confidence.

Last but not least, the regional financing arrangement or the Chiang Mai Initiative Multilateralisation (CMIM), is available to support regional countries facing short-term U.S. dollar liquidity problems. Tapping the CMIM resources will help regional economies to build buffers and alleviate the stress on external stability.

Way Forward

As the Covid-19 pandemic gradually comes under control, policymakers should prepare to normalize the monetary policy easing measures in a gradual and calibrated manner.

To avoid a “cliff” effect on the economy, the exit from the accommodative policy stance and debt relief measures and the phasing out of unconventional policy measures should start when there is clear evidence of a sustained economic recovery.

Moving forward, policymakers should pay attention to challenges in the post-pandemic environment arising from reduced economic resilience, lower potential growth, and widening economic inequality. These challenges need to be addressed by strengthened economic reform, improved social safety net, and skillful macroeconomic management.