More than 90% of the firms in Cambodia are micro, small and medium enterprises (MSMEs). Unlocking the growth potential of MSMEs is, therefore, key to the country’s long-term development by diversifying growth drivers, boosting employment, contributing to poverty alleviation, and enhancing the domestic component of the global value chain.

The Cambodian authorities have placed MSMEs on their development priority list, as reflected in the 4th Rectangular Strategy and the Industrial Development Policy 2015-2025, and the setting up of the SME Policy Action Committee, among other initiatives.

However, promoting MSMEs has been challenging, as it requires crosscutting solutions to address prevailing structural issues, which have been exacerbated by the fallout from the pandemic.

Financial access remains a major obstacle

In general, Cambodia’s MSMEs have limited capacity to upgrade their competitiveness and integrate into the global supply chain, often missing the opportunity to shift toward higher value-added activities. To help these MSMEs, the government needs to play an essential role in addressing some of the key structural constraints, including the low level of formal registration and proper bookkeeping, a lack of technical and regulatory support, limited productivity and innovation, and a shortage of skilled labor.

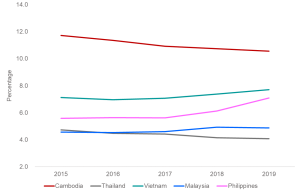

Another pressing and crucial issue, particularly during the COVID-19 pandemic, pertains to the lack of financial resources for the MSMEs. Small firms have struggled to attain financing from formal financial institutions due to a lack of sufficient financial records and tangible collateral (such as property). Often times, they can only access small amount loans which are very costly from informal financial institutions. In addition, the interest rates in Cambodia are higher than elsewhere in the region, making it even harder for firms to access financial resources (Figure).

Figure: Lending Rate in Selected ASEAN Countries

Source: International Monetary Fund/ Haver Analytics

*Interest Rate of Cambodia is for lending in foreign currency

The challenge in obtaining financing intensified during the pandemic due to the disruption in business activities, putting a large number of MSMEs on the brink of collapse. While the NBC’s loan restructuring program has helped maintain the funding for businesses, financial institutions have become more cautious about the increasing risk of defaults, especially among small businesses.

Unprecedented measures

In an effort to boost economic recovery, various fiscal measures of an unprecedented size have been adopted to enable MSMEs’ gain greater access to financing. Since the start of 2020, USD450 million (around 1.6% of GDP) has been allocated to establish a state-owned policy bank (SME Bank of Cambodia) and guarantee schemes, to provide government co-financing loans to local firms, especially MSMEs.

The SME Bank was established in early 2020 with an initial capital of USD100 million to extend accessible and affordable financing to MSMEs. The scheme targets MSMEs in priority sectors, consistent with the country’s Industrial Development Policy, such as manufacturing and assembling activities, digital innovation, and the information and communications technology sector.

The first phase of the co-financing scheme saw USD100 million of loans disbursed to 752 qualified firms, while the second phase is currently underway. Meanwhile, USD50 million in government loans were injected into the agriculture sector through the state-owned Agricultural and Rural Development Bank to support SMEs in agricultural supply chains.

Besides, the government also established a credit guarantee fund of USD200 million as a risk-sharing mechanism with financial institutions, guaranteeing up to 80 percent of individual outstanding loans. The scheme helps diversify and share risk with banks and financial institutions, encouraging a higher risk appetite.

These measures are expected to incentivize firms to formalize their business and allow them to expand their business operations through access to affordable and preferential credit, while also supporting the labor market. Although it is still early to assess their effectiveness, these schemes have received support from the private sectors.

In the medium and long term, government support could help MSMEs grow in size and capacity, thereby contributing to economic diversification, integration into the regional supply chains, and greater resilience and competitiveness, as noted in AMRO’s 2021 Annual Consultation Report on Cambodia.

Capacity building and risk management

Going forward, the authorities need to strengthen the monitoring of fiscal risks associated with the guarantee scheme and develop a risk mitigation strategy. In addition, promoting capital market development will increase the financial resources available for MSMEs, while improving corporate governance as a by-product.

It is equally important for the government to create a conducive environment for the MSMEs to enhance their capacity to obtain financing. Key initiatives include promoting the adoption of technology-based accounting management systems, facilitating the formalization of firms, and promoting the adoption of fintech products, such as peer-to-peer lending, credit scoring platforms, and digital payment systems.

The healthy development of MSMEs, with strong policy support from the government, could contribute to improving Cambodia’s economic competitiveness, realizing its long-term development vision.