Image: Amin Kassim / Shutterstock.com

SINGAPORE, January 13, 2023 – After the setback to growth last year due to the outbreak of the Delta variant of COVID-19, economic activities in Brunei Darussalam are gradually picking up, particularly in the non-oil and gas (O&G) sector. High vaccination rates have allowed containment measures and border restrictions to be lifted, enabling fuller economic re-opening. Higher global energy prices have also benefited Brunei Darussalam, helping to improve the external position and restore fiscal buffers. While the ongoing rejuvenation effort in the O&G sector has an effect on growth, the outcome would result in an improved asset reliability and production availability. Continuing diversification in the non-O&G sector, including the nurturing of new areas of growth (such as digitalization and green investment), will help foster resilience and put the economy on a stronger footing in the long run.

This preliminary assessment was made by the ASEAN+3 Macroeconomic Research Office (AMRO) after its Annual Consultation Visit to Brunei Darussalam from November 26 to 30, 2022.

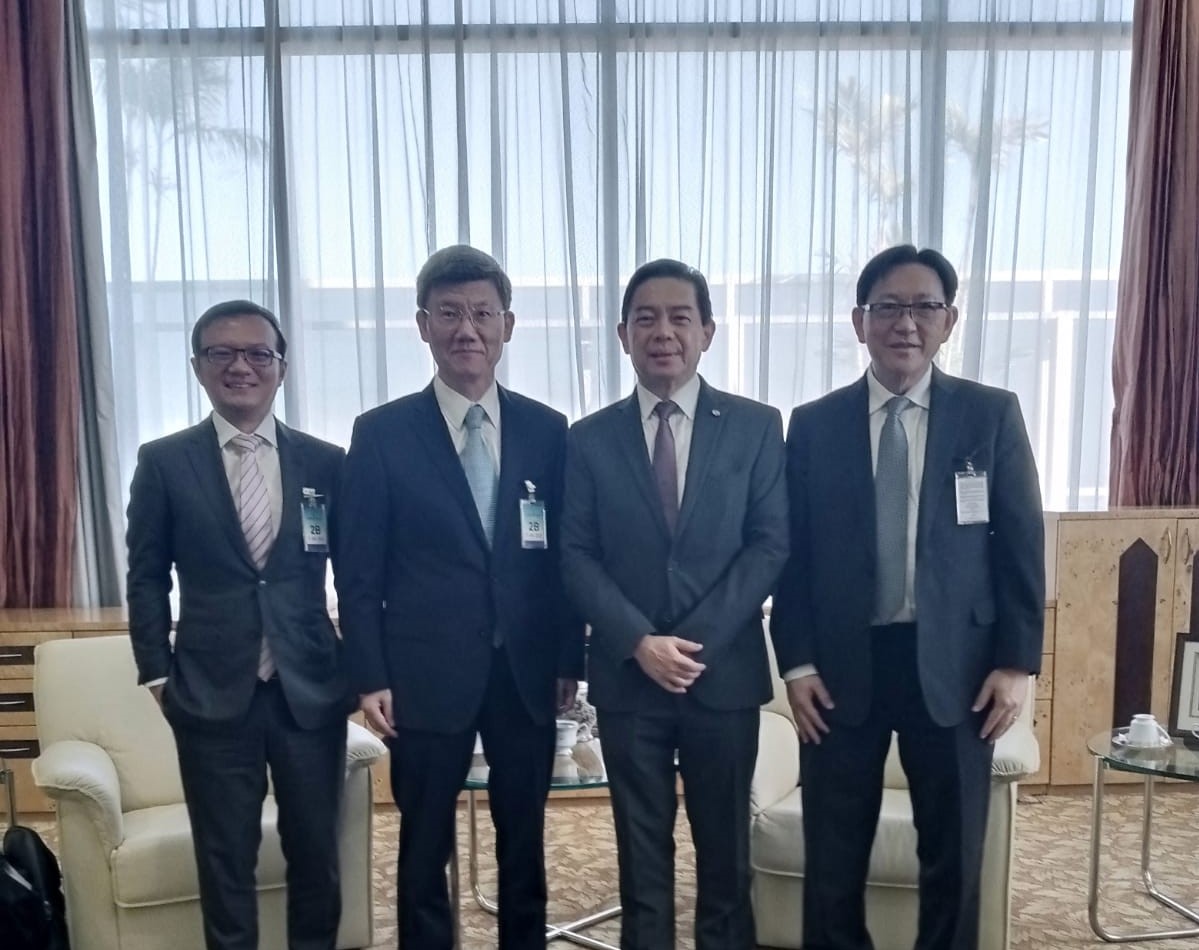

The mission was led by AMRO Deputy Group Head and Senior Economist, Anthony Tan. AMRO Director Kouqing Li and Chief Economist Hoe Ee Khor met The Honourable Dato Dr Amin Abdullah, Minister at the Prime Minister’s Officer and Minister of Finance and Economy (II), and the Managing Director of Brunei Darussalam Central Bank Hajah Rokiah Badar, and participated in the policy meetings. The discussions mainly focused on the outlook for the post-pandemic recovery, global spillover risks from the war in Ukraine and tightening global financial conditions, as well as longer-term development challenges.

Economic Developments and Outlook

“The highly comprehensive COVID-19 vaccination program has enabled Brunei Darussalam to shift to an endemic phase, allowing fuller economic re-opening and the recovery of economic activities, particularly in the services sector. Despite this positive development, the economy is expected to register a negative growth of 1.2 percent in 2022, weighed down by the decline in the upstream O&G production.” said Mr. Tan. “Nonetheless, the diversion of domestic gas supply to the downstream activities has contributed to stronger performance of the non-O&G sector, helping to support growth.”

Inflation has risen to a multi-year high, mainly on rising global food prices. The war in Ukraine has impacted global commodity prices and disrupted supply chains. While global commodity prices have fallen in recent months, inflation is likely to remain high at 3.7 percent in 2022.

The external position remains strong, with the overall balance of payments recording a sizeable surplus of 7.8 percent of GDP in 2021. This reflects the significant widening of the current account surplus to 11.2 percent of GDP on higher global energy prices. In 2022, the current account surplus is estimated to widen further to 12.8 percent of GDP, buoyed by favorable commodity prices and robust activities in the non-O&G sector.

Risks, Vulnerabilities and Challenges

Risks to the outlook are tilted to the downside due to the high uncertainties in the global energy market amid the fluid geopolitical developments, and concerns about the global economic prospects. While Brunei Darussalam has made good progress in economic diversification, the economy remains susceptible to both domestic and external shocks. The domestic risks include the challenges in rejuvenating offshore O&G fields. On the external front, a possible decline in global energy demand, reflecting a slowdown in major trading partners, would be a drag on growth.

The tightening global financial conditions and rising cost pressures could exert some downward pressures on corporate earnings in Brunei Darussalam—including those that are dependent on O&G exports. Sharply higher borrowing costs, coupled with slowing revenue growth could translate into higher debt servicing burden for some corporates.

Over the longer term, the decline in global demand for fossil fuels, driven by the transition to net zero carbon emission to limit climate change, is a perennial risk for Brunei Darussalam Extreme weather-related events not only result in significant losses to physical assets/infrastructure but could also strain public finances and pose systemic risk to the financial sector.

Policy Recommendations

The strong O&G export receipts from high oil prices have helped to restore Brunei Darussalam’s fiscal position. However, looking beyond the immediate terms of trade gains, continuing efforts to further diversify revenue sources would be desirable to shield the public finance against volatility and procyclicality. The authorities should also continue to press ahead with expenditure reforms, thereby strengthening fiscal consolidation in order to anchor medium-term fiscal sustainability.

Since May 2022, monetary conditions have tightened, given the upward adjustments in the central bank’s standing facility deposit and lending rates. The adjustments—mirroring the developments in Singapore’s interest rate—are appropriate, given the peg to the Singapore dollar under the Currency Interchangeability Agreement. The framework continues to be beneficial to Brunei Darussalam, helping to anchor macroeconomic stability.

In the financial sector, given the increased volatility in global financial markets, it would be prudent on the part of the authorities to strengthen the risk management framework for the monitoring of risks associated with banks’ lending activities and investment of excess liquidity abroad for higher returns. Further strengthening credit provision to the micro, small and medium enterprises (MSMEs) remain important to foster private sector growth and developments.

While the economic diversification progress so far is commendable, there is room to expedite the implementation of FDI projects in priority sectors (such as food, information and communication technology (ICT) and tourism). The authorities’ proactive approach on climate change should also continue, supported by appropriate budget allocation. Fiscal incentives can also be considered, for enterprises participating in climate change adaptation and mitigation. In other areas, such as the labor market, and in doing business environment, it is encouraging to note that various initiatives have been put in place, to address long-standing structural challenges. These initiatives, which are welcomed, are steps in the right direction.

AMRO would like to express its gratitude to the Bruneian authorities and other participating organizations for their cooperation and candid exchange of views. The strong support from the authorities and the excellent arrangement made this mission possible.

–

About AMRO

The ASEAN+3 Macroeconomic Research Office (AMRO) is an international organization established to contribute towards securing macroeconomic and financial stability of the ASEAN+3 region, comprising 10 members of the Association of Southeast Asian Nations (ASEAN) and China; Hong Kong, China; Japan; and Korea. AMRO’s mandate is to conduct macroeconomic surveillance, support the implementation of the regional financial arrangement, the Chiang Mai Initiative Multilateralisation (CMIM), and provide technical assistance to the members.

Courtesy call with Ministry of Finance and Economy. From L to R: Anthony Tan, Deputy Group Head and Senior Economist, AMRO; Kouqing Li, Director, AMRO; Dato Seri Setia Dr Awang Haji Mohd Amin Liew Abdullah, Minister at The Prime Minister’s Office and Minister of Finance and Economy II; Hoe Ee Khor, Chief Economist, AMRO

Courtesy call with Brunei Darussalam Central Bank. From L to R: Hoe Ee Khor, Chief Economist, AMRO; YM Dayang Hajah Rokiah binti Haji Badar, Managing Director, Brunei Darussalam Central Bank; Kouqing Li, Director, AMRO