In March 2020, Japanese banks experienced stress in their U.S. dollar funding due to a liquidity crunch in the U.S. dollar funding market. Although the overall global liquidity conditions have been relatively stable since then, the higher global interest rates could increase the funding costs of foreign currency funding instruments.

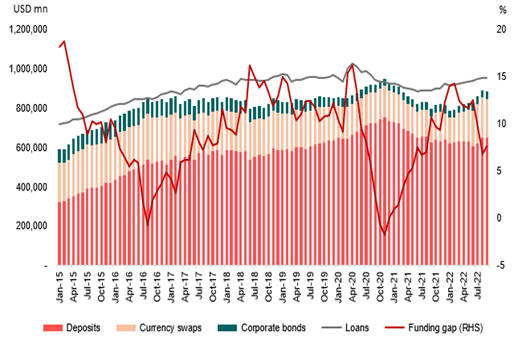

Amid tight global monetary conditions, Japanese banks might face a higher risk of not securing enough foreign currency funding, resulting in higher liquidity risks. The foreign currency funding gap, which is calculated as the difference between the amount of illiquid loans and stable funding in banks’ foreign currency balance sheets, widened again in early 2022 after a significant decrease in October 2020 (Figure 1).

Figure 1. Foreign Currency Funding Gap

Source: Bank of Japan

Japanese banks’ efforts to enhance stable foreign currency funding

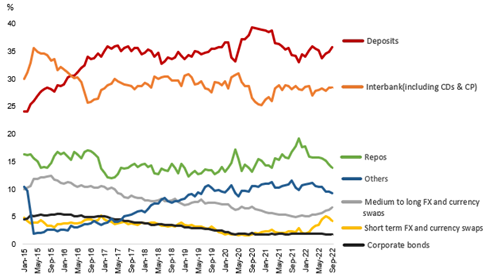

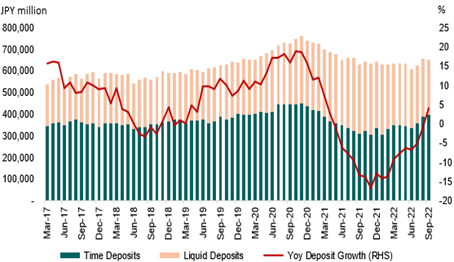

Given the liquidity risk associated with foreign currency funding, Japanese banks are attempting to secure more stable foreign currency funding through deposits. Since 2017, the foreign currency funding structure of banks has changed, with an increasing share of foreign currency denominated deposits, while other funding instruments have remained flat or experienced a downward trend (Figure 2). Moreover, the growth of foreign currency deposits accelerated in 2022, following a slowdown in 2021 (Figure 3). Japanese banks have also diversified their funding counterparties and increased their foreign currency deposits by expanding their transaction account deposits and further cultivating their relationship with non-Japanese depositors.

Figure 2. Components of Foreign Currency-denominated Liability

Source: Bank of Japan

Figure 3. Foreign Currency-denominated Deposits

Source: Bank of Japan

Policy options and other measures

The authorities have taken policy actions to assist banks in stabilizing their foreign currency funding. The Bank of Japan (BOJ) provided U.S. dollar liquidity support, such as the U.S. dollar funds-supplying operations, to help stabilize the market during U.S. dollar funding stress in 2020-2021. Although offering liquidity support can be used as a temporary policy measure during market turmoil, the authorities are continually evaluating vulnerabilities and identifying areas where further action might be the most effective when needed.

Accurate data collection and greater data sharing are essential to help the authorities monitor and identify any stress in banks’ foreign currency funding. As banks use multiple funding sources to maintain their foreign currency liquidity, it is necessary to consolidate data on foreign currency funding at each location to monitor foreign currency funding conditions and better manage the liquidity risk by avoiding the risk of term mismatches. Strengthening coordination between BOJ and the Financial Services Agency, and establishing an integrated data platform to collect statistics from banks promptly, will help the authorities keep track of foreign currency liquidity conditions at banks.

For banks, obtaining foreign currency deposits that are more stable even during market turmoil such as promoting settlement accounts by offering ancillary banking services, will help them maintain the stability of their overseas businesses over a longer period of time. Banks can also attract more retail deposits by considering the characteristics of depositors, offering relevant financial services for depositors based on their sensitivity to changes in interest rates, or promoting account opening via digital banking channels or smartphone apps with cash-back and loyalty points.

It is also important to ensure that banks adapt and upgrade their liquidity risk management framework. Incorporating a larger number of significant factors into early warning indicators, along with stress tests, will help banks estimate the risk of large future outflows in their foreign currency funds and better manage their funding gap.