One year on, the COVID-19 pandemic has caused massive human casualties, with more than 70 million confirmed infections worldwide and causing more than 1.5 million deaths. What started as a health crisis soon led to a global economic crisis, with many countries experiencing significant economic damages.

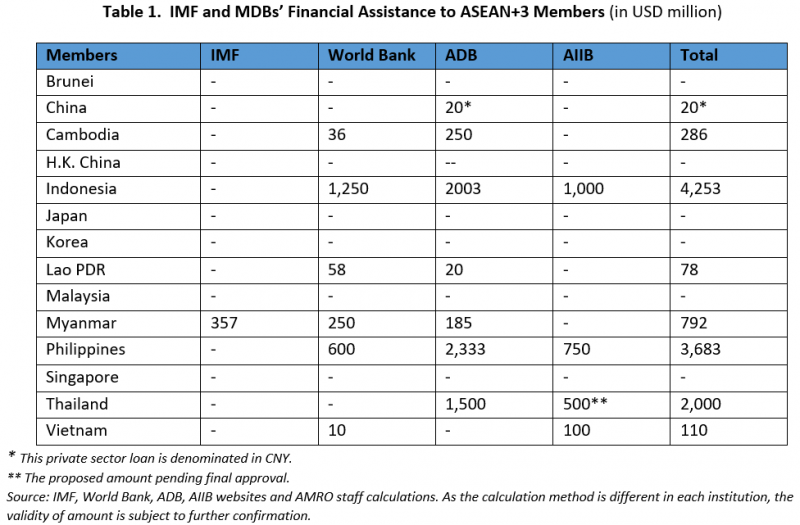

As key components of the global financial safety net, the International Monetary Fund (IMF) and regional financial arrangements (RFAs) have acted swiftly to safeguard financial stability by establishing new facilities, revamping the financial terms of existing ones, and augmenting financing resources. In addition, multilateral development banks such as the World Bank, Asian Development Bank, and Asian Infrastructure Investment Bank provide financing for development, structural reform, and budget support in response to the COVID-19 pandemic (Table 1).

Amid this turbulence, the economies in the ASEAN+3 region entered into the pandemic crisis with ample foreign reserves and adequate policy space for financial stability. So far, the ASEAN+3 economies have been battling the pandemic with less reliance on external emergency financing. While more than 80 countries have received financial assistance from the IMF since the onset of the pandemic, in this region, only Myanmar received IMF funding. The Chiang Mai Initiative Multilateralisation (CMIM), the region’s financing arrangement, remains untapped.

IMF and RFAs’ responses to the pandemic

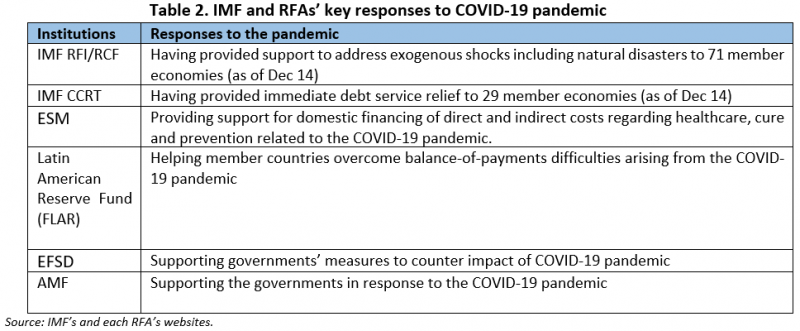

The IMF and other RFAs’ responses to the pandemic are largely in the form of fiscal support to boost healthcare and infrastructure spending. Major efforts have centered on building domestic budget capacity for vulnerable small economies or low-income countries, akin to providing international development aid.

IMF’s Rapid Financing Instrument/ Rapid Credit Facility (RFI/RCF) also complement support from the international community, such as the Debt Service Suspension Initiative backed by the G-20 and the Paris Club. Another mandate of IMF lending is to reduce poverty and promote growth in low-income countries through various facilities such as the Poverty Reduction and Growth Trust (CCRT).

On the other hand, the RFAs, with their local expertise, also support long-term development and regional integration, in addition to their core objectives of correcting balance-of-payments problems. For instance, the European Stability Mechanism (ESM) has provided support to the domestic financing of direct and indirect costs regarding healthcare, prevention, and treatment related to the COVID-19. Both the Eurasian Fund for Stabilization and Development (EFSD) and the Arab Monetary Fund (AMF) have supported their members’ measures to counter the impact of the pandemic (Table 2).

Enhancing the CMIM’s responsiveness

This pandemic has proven that each institution with a capacity to provide emergency financing should go hand-in-hand in providing comprehensive support to countries in need.

Having gone through several rounds of enhancements over the past 20 years, the CMIM Arrangement today has a combined firepower of USD240 billion and is fully operationally ready. The current CMIM in its sole operation is designed to address members’ short-term balance of payment and/ or liquidity difficulties.

However, for the low-income economies in the region, structural challenges have exposed their vulnerabilities, particularly during a crisis like the COVID-19 pandemic. These economies might face a widening current account deficit and debt burden, which can increase their liquidity risks. At the same time, they are still in the process of developing their domestic capital markets and gaining access to international market financing.

In this regard, there are potential gaps between the current CMIM arrangements to address short-term difficulties, and the long-term structural challenges a few member economies are facing, especially for low-income countries in the region. We are of the view that financial cooperation in the region could be further enhanced by developing a facility to tackle this challenge. This could be achieved either by reviewing the existing mandate of the CMIM and adding a new facility to the CMIM arrangements or by setting up a new regional financing mechanism outside the CMIM.

The post-pandemic world will be different. In order to thrive, our future economy must cater to address structural weaknesses. Going forward, there is an opportunity for ASEAN+3 members to strengthen the region’s financial safety net by addressing the diverse needs of all its 14 members.