Authors: Thessa Vasudhevan, Research Consultant, INSPIRE; Lea Reitmeier, Policy Analyst, Sustainable Finance, LSE; Aziz Durrani, Capacity Development Expert, AMRO; Simon Dikau, Distinguished Policy Fellow at the Grantham Research Institute and Research Director at INSPIRE

Central bankers and supervisors are beginning to acknowledge that broader environmental risks beyond climate risks, sometimes referred to as ‘nature-related’ or ‘nature risks’ are significant to the macroeconomy and financial system.

In this blog, we present an overview on how central bankers and supervisors in Southeast Asia can better understand and address broader environment-related, and especially biodiversity loss-related, financial risks.

Why does nature matter to financial regulators?

The nature-economy link

There has been significant emerging work to illustrate and build the evidence base for why nature and biodiversity loss can have significant economic and financial instability implications. At the heart of this stands the recognition that economies substantially depend on and impact ecosystem services. As economies have grown over the last 150 years, so too have the demands on nature to provide, support, maintain and regulate our activities. Indeed, we now find ourselves in a situation where the state of nature is eroding rapidly, due largely to these demands and their impacts on the biosphere. A quarter of species globally are threatened, and around one million animal and plant species face extinction. The Dasgupta Review on the economics of biodiversity finds that extinction rates are 100 to 1000 times higher than what they were (or their background rates) over the past tens of millions of years, and continue to rise. The widespread and accelerating rate of biodiversity loss, unmatched in human history, erodes the ability of the natural world to be productive, adaptable and resilient. It poses a significant risk to nature’s ability to provide the vital ecosystem services that we rely on to enable the functioning of economic, industrial and financial activities.

The pervasive degradation of the environment and nature could significantly impact the real economy. A World Bank report estimates that a partial collapse of ecosystem services, such as wild pollination, the marine environment or forests could result in a decline in global GDP of up to $2.7 trillion (2.3% of global change to real GDP) annually by 2030. The East Asia and Pacific region could be faced with an even higher relative contraction of real GDP, of 3.4% annually by 2030. These are conservative estimates given the limited range of ecosystem services considered and limitations to the modelling in the analysis. Southeast Asia, a region with three of the world’s megadiverse countries, where livelihoods and economic activities are inextricably dependent on ecosystems, faces particularly immense risks from nature decline, especially from species extinction and ecosystem collapse. This is alongside intensifying climate change, rapid urbanization and potentially unsustainable conversion of land to industrial and agricultural activities.

The nature-economy-finance link

The Dasgupta Review outlines how the economy is fundamentally embedded in nature, while biodiversity enables nature to be productive, adaptable and, importantly, resilient. The financial system, as a key part of the economy that enables economic activities, is also embedded in the biosphere. This means that ecological stability and integrity matters to economic and financial stability. It also means that our economic and financial systems have a major role to play in slowing and halting the contemporary overshoot of demands and impacts that humanity has had on the biosphere.

The Kunming-Montreal Global Biodiversity Framework adopted at the 15th UN Biodiversity Conference of Parties to the Convention on Biological Diversity (CBD) emphasizes this recognition of the role of the financial sector, and sets out targets that formalizes areas where financial sector policies and action would be needed to achieve biodiversity goals and shift investment away from nature-harming activities.

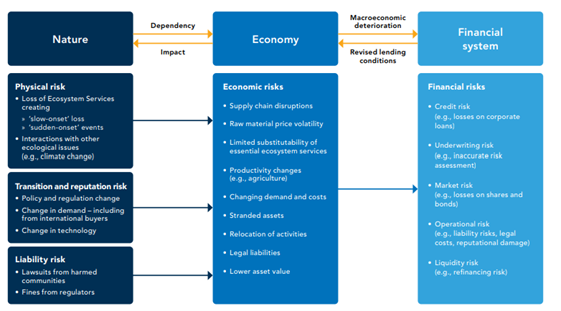

There is increasing evidence that nature loss poses macroeconomic risks, manifested as, for example, reduced commodity yields, output losses from disasters, and disrupted supply chains. These macroeconomic factors could ultimately transmit to the financial system. Furthermore, the failure to account for and manage the implications of nature loss, is itself a source of risk to financial institutions and financial stability. For central banks and supervisors, the task then is to adequately consider these broader environment-related-risks in the fulfilment of their core mandates.

How do nature risks evolve, how do they interact with climate risks, and how can financial regulators better conceptualize this?

The nature of nature-risks

The degradation of the environment can lead to the disruption or collapse of ecosystem services such as climate regulation, pollination, flood and storm protection, or disease control. These disruptions can create external shocks to economic activity, damaging physical assets and infrastructure, supply chains and business operations (e.g. the effects of extreme weather events and flooding or the spread of infectious diseases). This can lead to individuals, Micro, Small and Medium Enterprises (MSMEs) and corporates in the country and region suffering severe economic loss. This would then significantly impact the financial sector, with lenders and equity holders facing non-performing and impaired loans, as well as losses and write-offs in equity values. The losses they face could result in financial institutions and investors reducing or stopping lending to, or investing in, the related sectors of the real economy. This can create a negative loop which could lead to material economic and financial instability. Since ensuring financial stability is one of the key mandates of central banks, it is critically important for central banks to better understand the scope of such risks and to start taking preventative measures before such drastic consequences materialize. Furthermore, other supervisory authorities and wider government agencies, including ministries of finance, have a similar incentive to reduce and manage the level of nature loss.

The financial sector also indirectly contributes to these broader environment-related risks through the facilitation of economic activities that result in much of this harm to the natural ecosystem. There is acknowledgement that nature-related risks and biodiversity loss are partly endogenous. In contrast to exogenous risks, which arrive from outside the system, endogenous risks stem from shocks sparked and amplified from within the system. Depending on mandates and remits, central banks and supervisors could potentially have an even more important role to manage and reduce the scope of such activity within the financial sector, as it could consequently exacerbate the financial instability from biodiversity loss.

What makes addressing these broader environmental risks particularly challenging for central banks and supervisors to manage is that the contributions and exposures to nature-related risks are not necessarily symmetrical nor linear. For instance, if 5% of a bank’s portfolio is exposed to crop production activities that have dependencies and impacts on a range of ecosystem services, the disruption of those ecosystem services could affect not only crop yields, but also food production and food processing supply chains, potentially creating food security and commodity price issues that have cross-sectoral impacts. Now imagine that the same bank has 8% of its portfolio exposed to mining activities, which can severely degrade soil and cause habitat destruction and fragmentation. It is easy to see that the ‘entry points’ of these risks could be highly varied and interconnected. Therefore, a single financial institution may not directly or significantly be exposed to a particular nature-related risk, but the overall impact to the system can still be highly material.

Given the risk of contagion, the complexity of interdependence, and the deep uncertainty of tipping points and ecological regime shifts, it is difficult to estimate the exact channel and magnitude of how environment-related risks evolve and materialize. Further complicating matters is the interconnectedness of biodiversity loss and climate change, with potentially compounding effects, and the trade-offs between climate policies and environmental harm. Despite some overlaps of climate and environment-related risks, disregarding either, or having a narrow focus on climate aspects conceptualized as a single metric of GHG emissions would vastly underestimate risks and miss cascading or second-round impacts to the financial sector.

Toward a better understanding of materiality

Business activities contribute to and are exposed to nature differently. Some activities are characterized by particularly degrading and harmful impacts on the natural environment, while others have a high reliance on ecosystem services to conduct an activity. Acknowledging such local variations, ‘impact and dependency’ studies can help to shed light on potential financial exposures to nature-related risks. Besides the central banks of Netherlands, France, Brazil, and Mexico, Bank Negara Malaysia (BNM) conducted an assessment of nature-related impacts and associated dependencies of the financial system, conceptualizing a double materiality relationship between nature, economy and the financial system.

Source: World Bank and BNM. An Exploration of Nature-Related Financial Risks in Malaysia. Kuala Lumpur. World Bank. (2022)

The BNM study investigated 15 ecosystem services and found that 54% of the analyzed commercial loan portfolio was exposed to sectors that depend highly on ecosystem services. It also found that 87% of the analyzed commercial loan portfolio was exposed to sectors that have a high adverse impact on ecosystem services related to greenhouse gas emissions, water and land use. Besides individual risk factors, a set of nature related events that could be particularly relevant for banks in Malaysia were identified. These events could affect a combination of ecosystem services, and thereby a multitude of economic sectors. The highest banking sector exposures were to scenarios that affected a wide range of sectors due to continued high resource use, pollution and urban sprawl (44% of the portfolio), sudden and unexpected climate policy introduction (38%), and high rates of deforestation (30%). The exercise was useful to explore the variety of nature-risks that could be material to Malaysia.

Of significance from a supervisory and regulatory perspective, these impact and dependency studies can provide insights into the differences in the exposures of individual banks to these risks, arising from the focus of some banks in lending to certain sectors (e.g. the construction sector). Further comprehensive work exploring the concentrations of risk exposures could be a valuable next step in terms of risk assessment and to design associate supervisory responses. Focusing on static exposures is, however, only the start, as environmental risks can have wider macroeconomic implications, including potentially affecting the competitiveness of an economy. Environmental risks need to be assessed with a view toward an encompassing long-term policy outlook, and this is where scenario analysis can play an important role in exploring the complex and dynamic nature of these risks. There is also the potential to develop regional scenarios that could reflect local contexts better and incorporate both biodiversity and climate change aspects. Nonetheless, central banks should be cognizant of the challenges of scenario design and analysis, and be clear of the purpose of conducting such an exercise.

What are next steps for financial regulators?

While substantial advancements have been made globally in the past few years on how to measure and account for nature, there is still much work to be done in the practical incorporation of these broader environment-related risks beyond climate into financial frameworks. Nevertheless, it is positive to see that methodological supervisory frameworks for financial risks from biodiversity loss are currently being developed to provide better guidance on steps necessary to conceptualize the connection between nature, biodiversity, the economy and the financial system. Steps that can be taken for improved conceptual frameworks include work aimed at better understanding transmission channels (including contagion and feedback channels), identifying risk hotspots (on geographical/ ecosystem/ economic sector scales), understanding potential cross-border impacts, and understanding differences between direct and indirect risks (and their transmission mechanisms). Central banks and supervisors in Southeast Asia could potentially start by identifying key nature-related risk drivers relevant to their contexts and trace the connections between financial sector lending or investment activities and risk hotpots. In this context, the financial sector should carefully monitor lending activities to ensure they do not support harmful activities. Central banks may also want to consider whether they wish to set rules limiting banks from holding such higher risk exposures, potentially even subjecting them to additional capital surcharges where appropriate.

Despite the varying mandates of central banks and supervisors, differences in political economies and institutional capacities of their respective institutions and other government agencies, knowledge and information sharing forms a key part of building capacity to understand and address these broader environment-related risks. This is especially the case given resource constraints and conflicting priorities of central banks. Partnerships and cooperative networks with various stakeholders would be needed to strengthen technical capacity for such a paradigm shift in confronting nature-related risks.

Central bank policies cannot substitute broader national and international government action. Environmental regulations are fundamental to tackling the causes of environmental degradation and nature loss. However, given their financial stability mandate, central banks must play an important complementary role to this, at the very least by strengthening supervisory oversight and addressing knowledge and data gaps around such risks. They can further leverage their experience in assessing the financial materiality of risks and communicating financial and economic risks to their citizens, institutions and governments. The complexity of these nature risks requires intense and effective collaboration across all government agencies. Central banks and financial regulators can convene or partake in bringing different experts together to analyze risks and design policy actions. Cooperation with regional partners and sharing experiences with international counterparts is also a practical and cost-effective measure to build collective capabilities.

Beyond that, the endogeneity, non-linearity and the complexity of nature-related risks have also prompted calls for precautionary approaches to managing them. Under this approach, macroprudential policies would be employed in a pre-emptive way, aiming to mitigate systemic financial risks which are too onerous and time-sensitive to estimate or allow for market actors to self-adjust. These approaches can take the form of improving the efficacy of environmental regulation by integrating them into monetary policy and financial supervision, where mandates and remits allow financial policymakers to do so. At the extreme, governments may deem some economic activities to be too damaging to the economy and financial system and may significantly discourage, or even ban them. In this manner, credit flows can be steered in the economy depending on the contribution to environmental harm. Such approaches would require stronger coordination with other government departments, and a willingness to exercise discretion in the face of uncertainty. As the Dasgupta Review puts it, “there is a need to identify and reduce financial flows that directly harm and deplete natural assets”. Designing policies to manage the financial sector’s impact on nature would therefore be part of a comprehensive risk management approach to address environmental risks to support financial stability within economies.

To advance knowledge and capacity in this area, AMRO, together with the International Network for Sustainable Financial Policy Insights, Research, and Exchange (INSPIRE) held a regional roundtable in Singapore to discuss broader environmental risks in the context of Southeast Asia. The roundtable took place on the side-lines of the Network of Central Banks and Supervisors for Greening the Financial System’s (NGFS) Annual Plenary Meetings and the meeting of the NGFS Taskforce on Nature-related Risks. Participants of the roundtable included representatives from Bank Negara Malaysia, Bangko Sentral ng Pilipinas, Banco de México, Bank Indonesia, Ministry of Finance Thailand, Japan Financial Services Agency, Monetary Authority of Singapore, WWF Singapore, the Asian Development Bank, the World Bank, the International Monetary Fund and the Organisation for Economic Co-operation and Development.