Given rising government debt and continuing development needs, tax collection is essential for the Lao government to support economic progress while improving fiscal sustainability. However, tax revenue as a percentage of GDP has declined since 2013 while economic growth was relatively higher, particularly before the pandemic. This implies that the tax revenue has not fully benefited from strong economic growth.

Recognizing the importance of tax revenue, the authorities have implemented various tax reform measures and committed to further reforms.

Narrow tax bases and weak tax administration

According to AMRO’s Annual Consultation Report on Lao PDR 2022, Lao PDR’s tax revenue fell to 9.1 percent of GDP in 2020, after peaking at 14.1 percent in 2013. Even though it recovered to 10 percent of GDP in 2021, growth of tax revenue has slowed due to narrow tax base and weak tax administration.

Lao PDR’s Economic Census 2019-2020 revealed that 30.4 percent of business units registered their businesses with the Ministry of Industry and Commerce; 22 percent have a license, and only 12.9 percent have a tax identification number (TIN), implying a large informal sector. And the majority of micro and small enterprises lack proper accounting practices, making it challenging to collect taxes.

Weak tax administration and taxpayers’ compliance have also constrained more effective tax collection, leading to revenue shortfall. This is partly due to low staffing levels and insufficient administration resources.

Meanwhile, broad tax exemption and generous tax incentives, provided to attract foreign and domestic investment to national development projects, have limited tax collection from growing industries, including the electricity and mining sectors. This leads to a wider gap between economic and tax performances.

Tax reform underway

Various tax reform measures have been rolled out to improve tax revenue collection in the past five years. Noteworthy developments include the introduction of the Tax Revenue Information System (TaxRIS) and the integration of the Automated System for Customs Data (ASYCUDA) into TaxRIS. Smart Tax, which is the tax e-payment system, has been implemented to collect taxes and duties through the banking system, enhancing taxpayer’s compliance. The continued expansion of these e-tax systems will improve taxpayer services, facilitate other reforms, and reduce compliance costs.

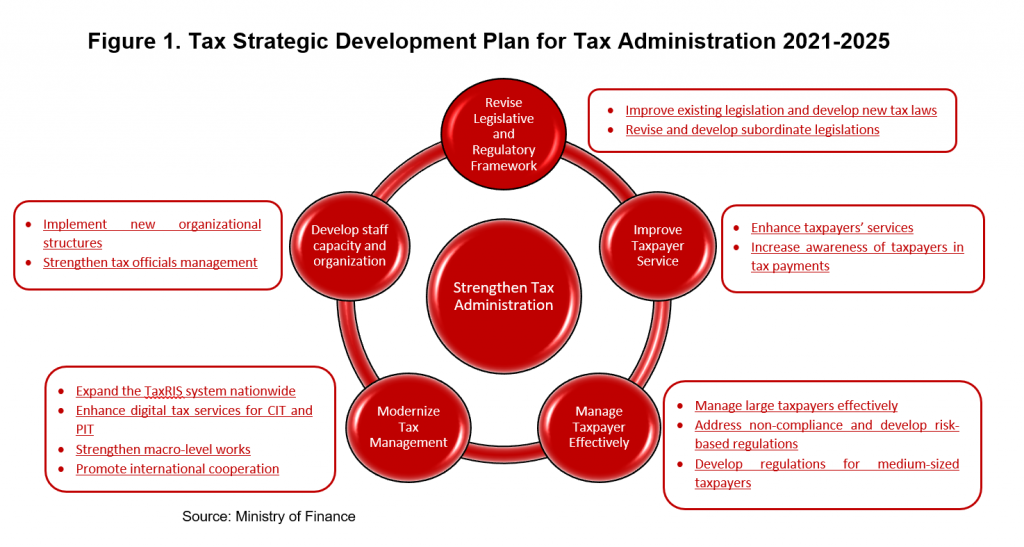

Furthermore, the Lao government implemented the Tax Strategic Development Plan (TSDP) 2021-2025, and highlighted revenue-enhancing measures in the 9th National Socio-Economic Development Plan 2021-2025, with the aim of raising the tax revenue by 5 percent of GDP by 2025. TSDP 2021-2025 will focus on improving tax administration and compliance by enhancing taxpayer services, modernizing tax collection, and developing the capacities of staff and organizations (Figure 1).

The authorities also plan to expand tax bases by encouraging Value Added Tax (VAT) and TIN registration. Expanding the VAT base has been achieved by reducing the Corporate Income Tax (CIT) rate to 0.1% for micro enterprises which register for the VAT system. For small and medium enterprises that newly register their businesses and in parallel participate in the VAT system, the CIT rate will be reduced for the first three years to 3 percent and 5 percent, respectively. Additionally, to mitigate the impact of the pandemic, the authorities have temporally cut the VAT rate from 10 percent to 7 percent.

For TIN registration, the Ministry of Finance (MOF) has been trying to link TIN to government database. TIN for business will be linked to business licenses, while a mobile application has been developed to allow individuals to use their TIN easily. Additionally, the authorities plan to expand TIN registrations by linking it with the National Identity Card and Social Security Card.

Considerations for a successful tax reform

The government has made good progress in Lao’s tax reform. Yet, policy considerations can be suggested to ensure its success.

The government should prioritize the measures after carefully assessing their implications on economic recovery. Given the economy’s weak recovery, tax reforms should be carefully calibrated to avoid hindering the recovery.

For example, measures involving only the public sector, such as improving taxpayer services and modernizing tax collection, can be expedited, while measures that increase the tax burden on the private sector can be gradually rolled out in line with the progress of economic recovery. In particular, the authorities could prioritize sectors that are recovering faster.

Broadening the tax base could also be a priority. Close coordination and cooperation between relevant government agencies is essential to efficiently link VAT and TIN registration to the national registration and identification systems. Fiscal incentives for registration and a government training program on book keeping and accounting could encourage micro, small and medium enterprises (MSMEs) to become more formal and enhance the tax base. A simplified accounting system for micro and small enterprises would also enhance their tax compliance.

Meanwhile, broad tax exemptions and incentives remain intact, especially for the resource sector, despite a large amount of foregone revenue. The design, management, and governance of tax incentives may need to be examined rigorously, as discussed in the Policy Consideration in Using Tax Incentives for Foreign Investment (AMRO’s Policy Perspectives, 2021). Measuring the foregone revenue due to tax incentives will be a first step.

As discussed in the AMRO blog “Strengthening Customs System can Boost government Revenue in Lao PDR”, reinforcing the country’s border control and customs system to increase formal trade flows, and expanding the ASYCUDA to the rest of border checkpoints, could boost government revenues.

Overall, a strong communication strategy will help gain public support for tax reform initiatives and measures, and enhance tax compliance.