By Monineath El

With a market capitalization of KRW23 trillion by H1 2022, Korea has been a hotspot for the virtual asset market due to lucrative returns on virtual asset trading, the so-called “Kimchi premium”. In particular, enthusiastic young Koreans in their 20s, 30s, and 40s, who have strong speculative motives in the virtual asset market, see investment in virtual assets as a path to prosperity.

Due to its highly speculative nature, the virtual asset market is exposed to risks of financial misconduct, tax evasion, lack of investor protection, and cyber-attacks. As a result, the authorities have adopted regulatory measures and tax obligations to contain these risks and the growth of the virtual asset market.

The story of Kimchi premium

The Kimchi premium refers to the excess in virtual asset prices of Korean exchanges compared with foreign exchanges, plausibly reflecting a lack of high-return investment options for investors in the country, as well as the Korean public’s interest in digitalization, including blockchain technology.

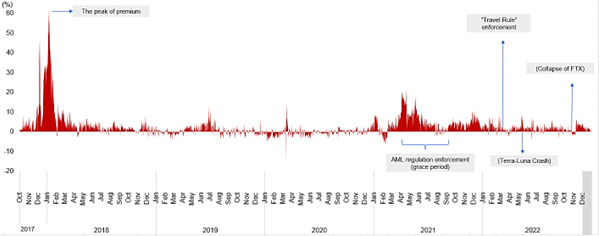

The premium has attracted non-Korean traders into the Korean virtual asset market, who have been the main driver of the bull market of virtual assets, which brought the premium to its peak at 60 percent in early 2018 (see Figure 1). In contrast, domestic investors have difficulty in profiting from Kimchi premium due to the capital controls aimed at curbing the cross-border flows of money to prevent arbitrage and financial misconduct.

Figure 1. Kimchi Premium and Major Events of Korea’s Virtual Asset Market

Source: AMRO staff estimation and calibration

Nevertheless, the Kimchi premium has started to flip to a discount, meaning virtual assets are cheaper in the Korean exchanges after the Korean government announced its plan to regulate the virtual asset trading in late 2018. There is also variation in premium across the years as the premium increased in the second quarter of 2019, decreased afterward, and rebounded in 2021 before dropping to a very low level of about 2 percent in 2022, stemming from economic slowdown and ongoing regulation enforcement.

Headwinds in the virtual asset market

Korea’s virtual asset market plunged in 2022, reflecting regulatory enforcement, the economic slowdown, interest rate hikes, and notably the loss of confidence in virtual assets in the wake of the Terra-Luna crash, according to ASEAN+3 Macroeconomic Research Office’s 2022 Annual Consultation Report on Korea. As of H1 2022, the total market capitalization of the virtual asset market in Korea was only KRW23 trillion, having fallen from KRW55.2 trillion in H2 2021.

The collapse of FTX, one of the world’s largest cryptocurrency exchanges, had only minor impact on virtual asset market in Korea because of strict management of customer deposits and transaction under the Act on Reporting and Using Specified Financial Transaction Information.

Regulating the virtual asset market

Since 2018, the government has tightened oversight of the virtual asset market by enforcing regulatory requirements and taxation, in order to safeguard investors, ensure financial stability, boost anti-money laundering (AML), and curb tax evasion. In particular, the government strengthened the Act requiring all virtual asset service providers (VASPs) to comply with information security management systems, anti-money laundering requirements, and travel rules and to report to the Korea Financial Intelligence Unit.

Additionally, the Financial Investment Income Tax was amended to levy a 20 percent tax on capital gains from virtual asset transactions of over KRW2.5 million. However, the Yoon government has postponed the implementation of this amendment till the end of 2023.

Nevertheless, the right mix of rules will balance the needs to spur innovation and create value-add for the Korean economy against the needs to protect investors and safeguard financial stability. The development of the virtual asset market will generate socio-economic benefits for Korea; capitalization of the Korean virtual asset market will reach KRW1,000 trillion, and about 42,000 jobs will be created by 2026, according to the Future of Asset 2022 report.

Overall, the newly drafted regulatory framework, Digital Asset Basic Act, will likely generate optimism for virtual asset market development and investor protection.