Image: junpinzon / Shutterstock.com

Philippine banks experienced a significant increase in non-performing loans at the beginning of the COVID-19 pandemic in 2020. Although the situation has improved with the recent economic recovery, can the Philippine banking sector maintain its soundness if any economic or financial risks materialize? How can the authorities help strengthen the resilience of the banking sector? The recently published AMRO annual consultation report on the Philippines answered these questions by applying a stress test on 17 selected Philippine banks.

The Philippine banks are resilient

In the stress test, AMRO designed three adverse scenarios against the baseline macroeconomic outlook: (i) a recession, which assumes the nominal GDP growth is 2 standard deviations below the baseline in 2022; (ii) an interest rate hike, as the short-term interest rate increases 2 standard deviations above the baseline in 2022; and (iii) a combined shock where scenarios (i) and (ii) take place at the same time.

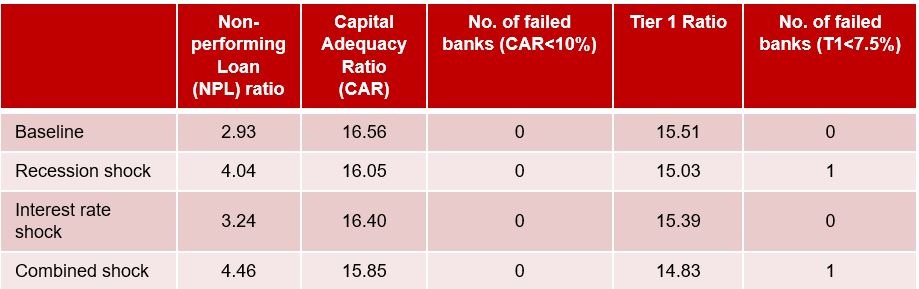

The stress test results suggest that the credit losses of the Philippine banking sector increase across various shocks. In particular, the credit losses increase significantly under the recession shock and the combined shock (Table 1). However, the Philippine banking sector remains resilient to shocks as the banks are well-placed to meet Bangko Sentral ng Pilipinas (BSP)’s capital requirements. Only one small-and-medium-sized bank needs to raise Tier 1 capital under certain shocks.

Table 1. Stress test results for selected banks

Source: BankFocus and AMRO staff calculations.

Note: The ratios are calculated by using the aggregate data of the banks in the sample.

Strengthening the resilience of small and medium-sized banks

Despite the Philippine banking system being quite resilient against the shocks, a few small and medium-sized banks may be vulnerable to shocks, given their lower capital adequacy ratios.

Currently, the BSP closely monitors and provides guidelines to systemically important banks to mitigate any systemic risk in the Philippine banking sector. However, small-and-medium-sized banks need more attention as they have less buffers and are less resilient to shocks, with relatively vulnerable balance sheets. Therefore, the BSP can consider strengthening the resilience of small and medium-sized banks by providing guidelines and support for their recovery and potential resolution.

Furthermore, some small and medium-sized banks are more concentrated in certain sectors, such as trade or tourism sectors and specific groups of borrowers, like medium-sized corporations. These banks are more vulnerable to adverse shocks. The BSP can offer help in designing a recovery and resolution plan for small and medium-sized banks.

In addition, the BSP can provide support on liquidity and new financial tools for these banks. For example, the BSP can provide policy support to guide the small and medium-sized banks to invest in green and sustainable projects.

Forward-looking regulatory framework

In addition, the BSP can provide guidance to all banks on formulating a forward-looking risk assessment and risk management scheme.

Specifically, given that a few banks have higher non-performing loans but lower provisions, the BSP can develop and strengthen pre-emptive, risk-based provisioning guidelines to absorb potential losses and require banks to provide sufficient provisioning.

To deal with potential credit losses, the BSP can stand ready to enforce regulations on those banks, such as by increasing retained earnings and restricting dividend distribution, so as to maintain a higher capital adequacy ratio until pandemic-related uncertainties dissipate.

In addition, the forward-looking regulatory framework can be enhanced by strengthening the role of the credit bureau. The credit bureau consolidates the credit information of borrowers which would enhance banks’ ability to conduct a comprehensive assessment of leverage. In particular, banks can assess the quality of borrowers in specific sectors and groups so as to reduce credit risks. In the Philippines, the Credit Information Corporation (CIC) plays the role of a credit bureau. The authorities can enhance the role of the CIC and the usage of its credit database by encouraging banks to contribute credit data to CIC’s credit database, and make reference to the credit quality data when accessing the borrower’s financial conditions.

In conclusion, while the stress-test shows that the Philippine banking system is quite resilient to shocks, there is room for more policies to support small and medium-sized banks as well as enhance the banking sector’s risk assessment and management.