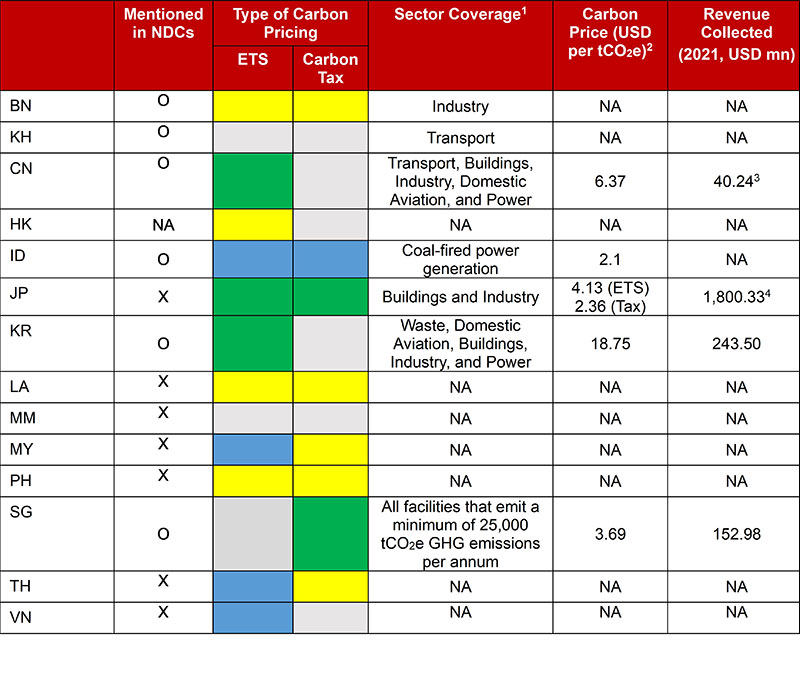

The progress of carbon pricing implementation — an effort to internalize the social cost of emissions into the carbon price — varies across ASEAN+3 (Table 1). Had its implementation not been delayed last year to avoid additional pressure on the high inflationary environment, Indonesia would have been the second country in ASEAN, after Singapore, to introduce a carbon tax.

Table 1: Carbon Pricing in ASEAN+3 Economies

Source: Andriansyah and Hong (2022)

Note: ■ Fully implemented; ■ Under development; ■ Under Consideration; ■ Undecided; NA= Not Available. BN = Brunei; CN = China; HK = Hong Kong, China; ID = Indonesia; JP = Japan; KH = Cambodia; KR = Korea; LA = Lao PDR; MY = Malaysia; PH = the Philippines; SG = Singapore; TH = Thailand; and VN = Vietnam; CO2e stands for carbon oxide equivalent, a metric measure that is used to compare the emission from various GHG that equivalent amount to carbon dioxide with the same global warming potential (https://ec.europa.eu/eurostat/statistics-explained/index.php?title=Glossary:Carbon_dioxide_equivalent).

1 Sectors mentioned in NCDs or covered in the current/planned ETS/Carbon Taxes; 2 Average prices as of April 1, 2022; 3 Chongqing pilot ETS; 4 Japan Carbon Tax.

As an integral part of a tax reform package, Indonesia enacted a law in 2021 that pledges to implement a carbon tax by 2025. The initial plan was to implement the so-called “cap-and-tax” scheme for coal-fired power generations from April 1, 2022. This was postponed to July 1, 2022 and, as of February 8, 2023, extended sine die. The Indonesian government explains that it needs more time to settle any issues regarding implementation regulations and remains fully committed to implementing the scheme to benefit the domestic economy.

What is a cap-and-tax?

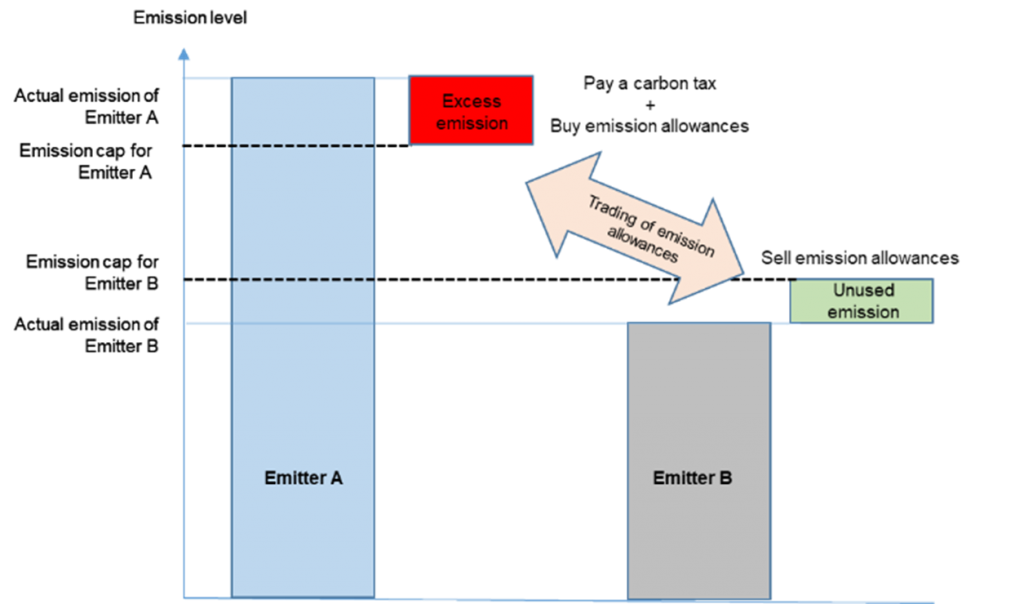

Generally, there are three direct carbon pricing instruments: an emission trading system (ETS), a carbon tax, and a carbon crediting mechanism. A cap-and-tax scheme is an innovative way of combining an ETS and a carbon tax, where an emitter can buy emission allowances and/or pay a carbon tax to offset its excess emission (Figure 1).

Figure 1: A Cap-and-Tax Scheme

Source: Andriansyah and Hong (2022)

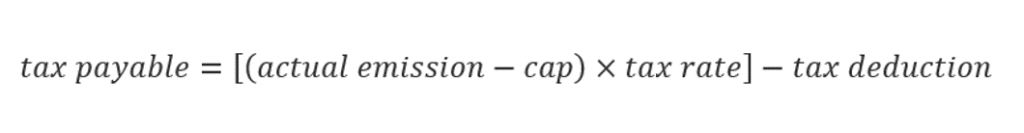

Under a cap-and-tax scheme, the government will first set a cap on the emissions of each emitter and then impose a tax when an emitter emits more than it is allowed. Acting as a Pigouvian tax that tries to affect taxpayers’ behavior, Indonesia’s cap-and-tax scheme offers a tax deduction if an emitter buys carbon market allowances from another emitter’s unused allowances, or utilizes carbon offset certificates earned when the emitter invests in voluntary emission reduction projects. In tax terminology, emitters are the subject of the tax, while the object of the tax is any activity that uses fossil fuels that causes carbon emissions. Under the polluters-pay-principle, the amount of tax payable at the end of the year can be calculated as follows:

This cap-and-tax scheme was first introduced by Indonesia as a lesson learned from a voluntary ETS trial conducted in 2021 with 32 coal-fired power plants participating. The trial result showed there were more deficit firms (that emitted more) than surplus firms (that emitted less), stimulating 28 transactions with the value of 42,455 tons of CO2e. The average price formed in the trial was USD2 per tonne of CO2e emissions, which is now proposed for the carbon tax rate. The law, however, says that the carbon tax rate must not be less than the domestic carbon market price, implying that the scheme will perform as a vehicle to accommodate the gradual development of the carbon market in Indonesia.

A carbon tax in a high inflationary environment

Introducing carbon pricing instruments can be a big challenge for policymakers in a high inflationary environment. Carbon pricing raises the marginal production cost and directly affects the prices of products and services produced by emitters, which could be passed on to the prices of other products and services.

Given the elevated inflationary pressure, a postponement makes sense for now. However, an extended delay in implementation may create problems such as increasing carbon leakages, distortion of resource allocation, and trigger the implementation of cross-border carbon price adjustment systems. So, policymakers need to announce a credible carbon pricing policy as part of their post-pandemic fiscal adjustment plan to provide a clear signal for emitters and to gain public support.

Other challenges and policy considerations

A high inflationary environment is not the only issue; there are other challenges faced by Indonesia and other countries. For example, to mitigate the side effects on economic growth and poverty, a comprehensive carbon pricing policy package should be adopted, including appropriate growth strategies and redistribution policies.

Supplementary sectoral measures will help reduce emissions effectively and offset losses from stranded assets in negatively affected sectors. These policies require large-scale resource rebalancing to maximize the positive impact of carbon pricing while curbing its negative impacts. Additional revenue generated from the carbon pricing policy could be earmarked to finance mitigating policy measures.

Lastly, strengthening international cooperation in implementing carbon pricing could help minimize carbon leakages which impact global competitiveness. The cooperation can be in various forms, such as carbon price harmonization, pricing scheme coverage extension, fossil fuel subsidy reduction and international sectoral agreements.